Market Update: How Battery Pack Costs Declined Since 2008

Electric vehicles, renewable energy systems, and grid energy storage all rely on efficient and affordable energy storage solutions, primarily lithium-ion batteries. The cost of battery packs has been a significant factor in the adoption of these technologies, and recent developments show that we’re moving in the right direction as prices drop. Let’s look at the advancements in battery cost reduction, navigate through supply chain complexities, and explore the promising prospects ahead for the EV market.

The Dramatic Decline in Battery Costs

The Energy Battery Pack in electric vehicles is a key component in storing the energy needed to power the vehicle’s electric motor. But the price of these batteries had been a major roadblock to electric vehicle adoption. The good news is that things are starting to change.

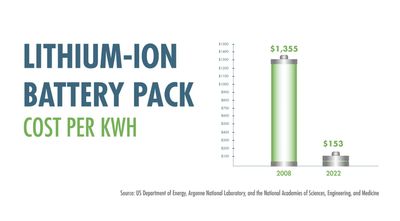

The US Department of Energy’s Vehicle Technologies Office reported a remarkable 89% decrease in the cost of electric vehicle lithium-ion battery packs between 2008 and 2022. In 2008, the cost per kilowatt-hour (kWh) was $1,355, but by 2022, it had dropped to $153 per kWh.

The remarkable decrease in cost can be chiefly ascribed to progress in battery technologies and chemistries, alongside a substantial rise in production quantities as the world moves to meet the growing demand of a renewable energy-based market.

But that doesn’t mean prices are set in stone.

In fact, the prices of lithium-ion battery packs actually went up a bit in 2023, compared to 2022, increasing by about $10. With that in mind, the industry is focusing on investing in research and development process improvements and expanding capacity across the supply chain to tackle any potential price hikes. These efforts are expected to pave the way for next-gen battery tech – such as silicon and lithium metal anodes, solid-state electrolytes, and new cathode materials, as well as improved cell manufacturing processes – all of which can help cut costs even more.

This substantial price drop suggests that electric vehicle costs could significantly decrease, potentially boosting EV adoption. But there are also broader implications for manufacturing and the possibilities that arise from this dramatic shift.

Expanding Battery Manufacturing Capacity in North America

In North America, the United States is the leading market for lithium-ion batteries.

The expansion of battery manufacturing facilities in states like Kentucky, Tennessee, Georgia, and Michigan will significantly boost North America’s battery production capacity, increasing from 55 Gigawatt-hours per year in 2021 to nearly 1,000 GWh/year by 2030. This is expected to support the annual production of 10 to 13 million all-electric vehicles by 2030.

One goal of the Inflation Reduction Act, which updated the Clean Vehicle Credit for new and used EVs, was to promote US manufacturing. Now EVs must meet minimum requirements for the critical minerals extracted or mined and battery components manufactured or assembled in North America. Because customers must buy a qualifying EV in order to claim the tax credit, these battery manufacturing requirements will lead to increased demand from North American battery manufacturers.

The U.S. Bureau of Labor Statistics notes that there is an uptick in labor demand across four key sectors, including battery manufacturing. These jobs are not only in high demand as the market continues to grow, but they also help maintain a robust and growing network within the United States, particularly in the electric vehicle industry. By keeping these manufacturing jobs in the U.S., the country can also advance its domestic mining, production, processing, and recycling of critical minerals and materials. This approach ensures that the resources needed for electric vehicles stay right within the American economy, ultimately resulting in electric vehicles that are genuinely “Made in America.”

This means the United States not only excels in electric vehicle manufacturing and lithium-ion battery production but also ensures that the country is increasingly energy secure.

The Global Impact of Battery Cost Reduction

The global significance of this cost reduction cannot be overstated. Lithium-ion batteries have emerged as the most efficient and cost-effective energy storage solution. As prices continue to fall, it becomes increasingly practical to adapt to low-carbon energy systems, further reducing global greenhouse gas emissions.

Historical data is an eye-opener. A battery with a capacity of one kilowatt-hour that once cost $7,500 in 1991 was only $181 in 2018, marking a remarkable 97% decrease in just three decades. Notably, prices reduced in half between 2014 and 2018, illustrating the accelerated pace of innovation.

Supply Chain Challenges and Opportunities

While it’s encouraging to see battery costs coming down, let’s not overlook some significant hurdles in our supply chain. The U.S. Department of Energy has analyzed them In a report called “Battery Critical Materials Supply Chain Challenges and Opportunities,” the US Department of Energy analyzed some of these issues.

The report stresses the need to test new technologies on a smaller scale, make better connections throughout the supply chain, and ensure that resource diversification is a top priority. In addition, one big issue is the lack of investment in scaling up technologies for lithium extraction and processing. The DOE notes that funneling research and development funding into these areas could help lower risks, reduce costs, and improve the economics of these projects.

Toward a Clean Energy Future

The current state of renewable energy owes a significant debt to the development of lithium-ion batteries. The substantial decrease in the costs of energy battery packs over the last decade highlights the advancements in the renewable energy industry. Although supply chain issues persist, the potential for progress is here. By concentrating on the advancement of new technologies and the acquisition of essential resources in North America, we move closer to a future where cost-effective, environmentally friendly, and efficient energy solutions power the world.

Copyright © 2023 RMPAC EV - All Rights Reserved.

Powered by RMPAC EV

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.